Straight-through AP invoice processing isn’t a dream or a theoretical vision. Straight-through AP invoicing is achievable and explained clearly in this white paper, including how it can be realized by any AP organization. Your implementation checklist at the end!

As technology evolves, automation of tasks and functions that require paper has become expected, and AP invoicing is no exception. Many companies don’t just want to say goodbye to AP paper; they want straight-through processing. There are numerous benefits of a straight-through AP invoice process, including increased efficiency and eliminating friction between AP and other departments within a company.

Table of Contents

What is straight-through AP invoice processing?

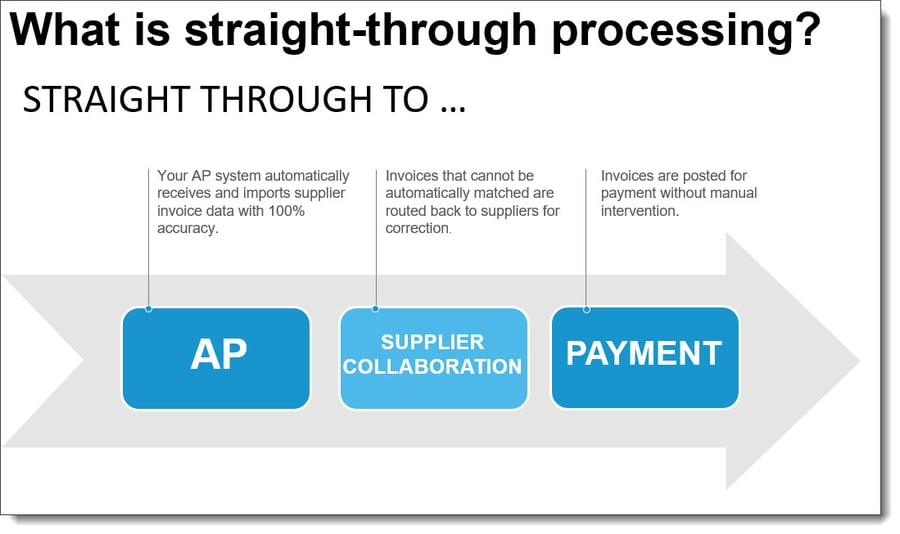

So, what is straight-through AP invoice processing? Straight-through AP invoice processing is when an invoice comes from a supplier into an AP system ready to pay. It is straight-through when AP does not have to intervene in any manual way. As you can imagine, straight-through

enables a very fast cycle time.

How is straight-through AP invoice processing possible?

It involves more than technology. It also requires procurement departments enforce PO usage within an organization. While there are several efficiencies that can be improved around non-PO invoicing, to truly straight-through process an invoice there needs to be an associated PO. Ultimately, the nature of a non-PO invoice is that it needs to be touched as it always has to be approved and coded.

It’s a combination of process and technology that enables you to achieve the goal of straight-through processing. It's a coordinated eort within your organization. You need AP, Procurement, and IT working together to get the highest straight-through processing rates possible.

What are the benefits of straight-through processing?

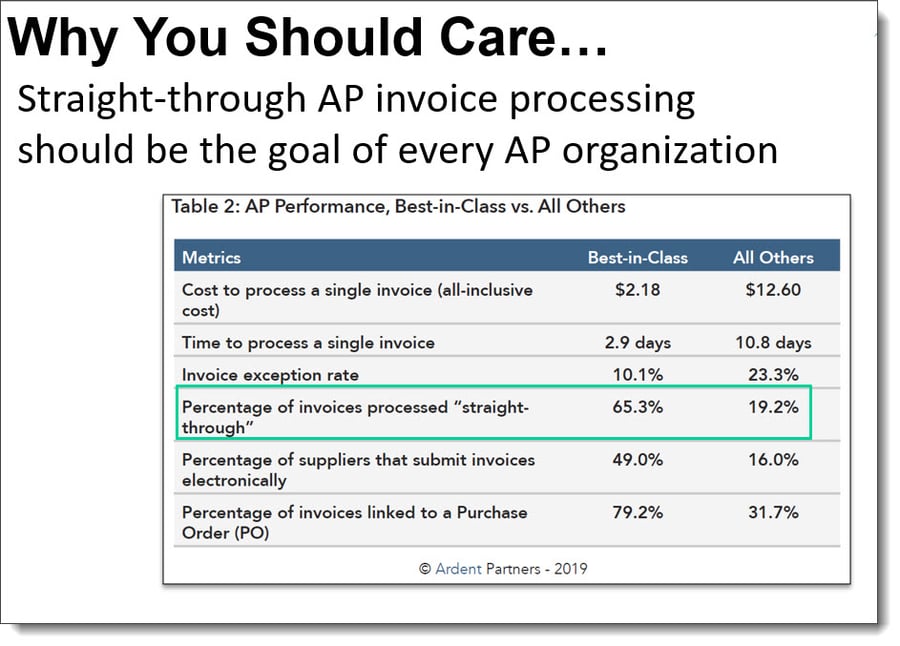

Best in class AP departments are hitting a rate of about 65% of invoices processed straight-through. Transcepta has seen significantly higher rates, as high as 99%.

Touching invoices and managing invoice exceptions in AP is the single biggest cost driver and cause of inefficiency in AP departments. And, perhaps quite obviously, it's one of the most significant areas for improvement that we have seen across the board.

Other departments in your company can benefit from straight-through processing as well. Procurement will enjoy the tighter, more efficient supplier relationships. From a finance perspective, you're able to improve the visibility into your outstanding liabilities. Your treasury department is going to be able to scale out cash management programs as well. These programs include the more traditional early pay discount programs or some of the sophisticated dynamic discounting initiatives that we see out there in the market.

Enterprise ERP systems and straight-through processing

Best-in-class ERPs deliver software around system-of-record and core business functionality for an organization across departments. They offer a great deal of back-end functionality that enables companies to be more efficient and sophisticated in the work they do daily.

But if you want straight-through processing, you're not going to get there with an ERP system alone. Your department is still going to be touching invoices, and your cycle times are going to be inconsistent. And definitely, there will be some frustration between you and your suppliers because you still have a manual element to how you process invoices.

Some enterprise ERPs offer applications with optical character recognition (OCR) built right into the system. For example, Oracle has embedded technology called Oracle Integrated Imaging. Essentially Oracle Integrated Imaging is an optical character recognition (OCR) solution that offers some improved efficiency in invoice processing. But OCR technology, although better than manual data-entry is still far removed from a straight-through process.

.jpg?width=930&name=iStock-1037076588%20(1).jpg)

What is wrong with OCR?

If you're using OCR, you are going to have to touch invoices. There are a couple of reasons for that.

First, even the best OCR technologies on the market today still have an error rate. By definition, OCR is trying to turn an image into data. You will need AP team members to review those invoices to make sure that the conversion happens correctly.

What is even more problematic with OCR is that there is no connectivity to your supplier. Your supplier is sending in a piece of paper or emailing an image, or the like. If anything goes wrong, there is a breakdown in the connectivity to you, the customer. Manual intervention is always the answer in this case.

There's no communication mechanism for you to go back to the supplier in an efficient way, or an automated way using technology, that says, "Hey, you sent an invoice that has an error, or is incomplete, or has a problem with it." That's an ongoing problem that you're going to have to deal with in AP when using OCR technology.

For straight-through AP invoice processing, the first thing you need is to receive invoices in a true, electronic invoicing format. You need that connectivity to your supplier, and you need to receive an invoice in your required data format without scanning and OCR. It's a fundamental baseline for even starting a project around straight-through processing. You've got to have true e-invoicing in place.

Is an emailed PDF e-invoicing?

True e-invoicing means receiving invoice data in a digital format such as EDI, XML or CSV. True e-invoicing is not, however, receiving a PDF. If a supplier sends a PDF and you try to convert it into data using another provider, that provider is going to use OCR. PDF processing is usually a nonstarter in terms of achieving straight-through processing.

However, Transcepta can take a PDF invoice and convert it into true electronic data without using scanning and OCR. Transcepta can map at the data level into the electronic properties of the PDF.

The vast majority of your suppliers have the capability to email PDF invoices from their billing system and prefer emailing a PDF. If you're already using Transcepta, then you have bona fide electronic invoicing. If you're not using Transcepta, your best bet is error-prone OCR.

An advanced supplier network critical for straight-through processing

The next thing required for straight-through invoicing is an excellent supplier network. A good supplier network does several things, including the most important — it allows you to collaborate with your supplier in an automated, electronic way.

If a supplier sends an invoice and it doesn't meet your business requirements, you need to stop that invoice before it gets into your system and automatically request a correction from the supplier. To realize this kind of automatic validation and notification, you need an excellent supplier network with true connectivity. This is the only way to ensure the best straight-through processing rates.

AI technology ensures straight-through processing

Machine learning, a branch of AI, also allows you to leverage a supplier network. A good supplier network like Transcepta will allow you to prevent AP exceptions from occurring right at the source.

Transcepta’s product PO Cloud Match is an example of AI technology that makes powerful automation happen throughout your supplier network and ensure straight-through processing.

If you've ever tried to import an electronic invoice into an ERP system, and you did not have PO line numbers on the invoice, you truly understand how difficult this task is. The invoice immediately becomes an exception, and your AP team is now required to manually match the invoice and PO lines. The challenge is that the vast majority of suppliers are not able to easily put PO line numbers on invoices, if they can at all.

Transcepta’s PO Cloud Match uses advanced algorithms applied to invoice data and PO data to predict and populate PO line numbers, even when the supplier hasn't provided them. This unique feature is a critical driver in ensuring high straight-through processing rates.

Frictionless for suppliers to onboard

To get to straight-through AP invoice processing, supplier connectivity must be frictionless. Charging suppliers to participate in your solution-invoicing initiative slows down adoption and creates friction in the process. Suppliers end up raising their fees and charging their customers in the long run. Transcepta never charges suppliers to join the Transcepta Network.

Transcepta’s strength lies in its lead time as its technology enables supplier connection in a matter of minutes. Even the most sophisticated suppliers that prefer EDI or XML, which can traditionally take weeks of back and forth to establish connectivity, can be connected within a business day with Transcepta.

Supplier adoption is critical to achieving straight-through processing.

Conclusion

Straight-through AP invoice processing is achievable for any AP organization and will result in increased efficiency for your AP and Procurement departments as well as for your suppliers. The steps to implementing straight-through are straightforward and can be implemented readily.

Your straight-through goal

Best-in-class is 65%+ straight-through AP invoice processing, with 99% straight-through achieved by Transcepta customers.